As at 22 May 2018, US 10-year treasury yields have broken through the psychological 3% barrier, currently standing at 3.07%. Perhaps equally as important is the 2-year treasury yield, currently 2.57%.

10-Year 2-Year Spread

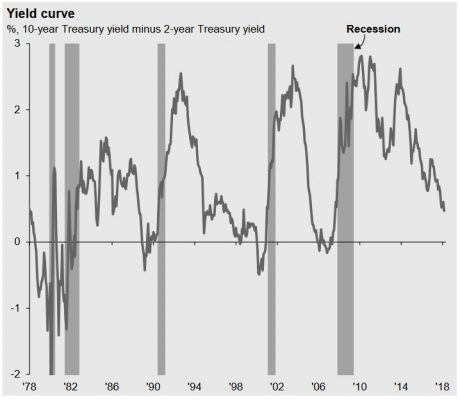

The chart below (Source: JPMorgan Asset Management) shows the changing 10-year 2-year spread (which is simply the difference between the two). In recent years, it has declined substantially.

The 10-year 2-year spread has traditionally been a reliable indicator of both market peaks and recessions. When there is an “inversion”, i.e. the 2-year yield becomes higher than the 10-year yield, there is on average 13 months before the S&P 500 index reaches its peak, and 17 months until a recession, according to JPMorgan.

We are not there yet, as the spread is currently +0.5%, but as the Federal Reserve continues its interest rate raising cycle, market participants will be looking ahead to future rate cutting. In practical terms, this means that short term interest rate expectations will be higher than long term interest rate expectations, and the yield curve will invert. The UK is further away, with a spread of +0.69%.

We are underweight US equities as we consider the US bull market to be closer to its peak than other markets around the world.

One reason why the inversion may herald a market peak is because of the way the so-called “risk free rate” is priced from US treasuries.

As yields become more attractive from treasuries, the return required for buyers of equities increases. Equities reprice (i.e.fall) so that their earnings and dividend yields can maintain their spread (i.e. gap) over treasury yields. The lower price also means that future returns are more likely to be higher. The risk profile of other assets changes when the risk free rate changes.

At the moment, only US investors are able to benefit from higher US treasury yields, since the costs of currency hedging are so high for UK investors, that it negates any benefit over investing in their home treasury market.

Opinion

We do not like bonds, because rising bond yields means lower bond prices. We prefer defensively positioned UK equities whose share prices have already experienced a correction and are better positioned to offer good returns during any future stock market turbulence.

Article market data as at 22/05/2018.

Risk Disclaimer: The value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance. This document is not intended as investment advice. Any security mentioned in this commentary is for information purposes only and is not a recommendation to buy. Wealth Matters is 4 Shires opinion led commentary. The contents of this webpage are for general information only and do not constitute investment or financial advice. This is not a recommendation to buy or sell any security or to take any action.