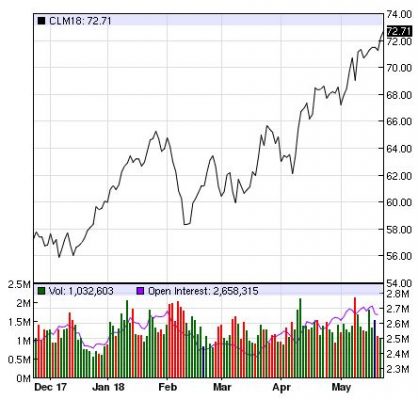

Over the past few months, oil has continued to rally, thanks to combined risks of supply shortfalls from both Iran and Venezuela. Since the lull in February, West Texas Intermediate (WTI) crude oil has risen from circa $58 to circa $73 (as at 22/05/2018), a rise of over 25% in circa 3 months. Brent crude is now $80 per barrel (as at 22/05/2018).

WTI crude; graph source: NASDAQ

Regional Outlook

Venezuela has suffered a 40% drop in output since 2015, with state oil company PDVSA producing 1m fewer barrels per day (bpd) than December 2015. The country continues to be mired with hyperinflation (the IMF predicts inflation of 13,000% for 2018), and widespread food insecurity. President Maduro won snap elections on 20th May, and given the unlikelihood of said elections being free and fair, the US could impose sanctions on Venezuelan oil following the poll.

US sanctions are already being expected for Iranian oil, following the withdrawal by Donald Trump from the nuclear deal. This could remove 500,000 bpd from Iran’s exports by the end of 2018.

OPEC and Russia entered a deal in January 2017 to cut 1.8m bpd of output, and it seems unlikely that Saudi Arabia, OPEC’s de-facto leader, will feel inclined to reverse this. The Kingdom is seeking to float Saudi Aramco, and a high oil price will support a higher price for Aramco’s shares. This is key to Prince Salman’s plan to shift the Saudi economy away from oil.

Thus far, Iraq is the only OPEC member not to have cut production. The Iraqis have voted in their election, with Shia cleric Muqtada al-Sadr controlling any government coalition negotiations. Iran has voiced its displeasure with Sadr and his election could add additional turbulence to an already troubled region. Iraq may end up meeting OPEC cut targets, although perhaps not intentionally.

The general commodities slump of 2014-15 has lead to massive underinvestment in capacity, with Wood MacKenzie estimating a capital expenditure cut of $1tn.

There are also new international shipping regulations coming into effect by 2020, which require vessels to burn lower sulphur fuels. Morgan Stanley expect diesel and marine gasoil demand to increase as a result, in turn dragging up demand for crude oil.

Forecast

A sustained high oil price may lead to a drop off in demand, but the IEA is still predicting global demand growth of 1.4m for 2018. We think the oil price will continue to be firm through the rest of the year.

Risk Disclaimer: The value of investments and the income you get from them may fall as well as rise, and there is no certainty that you will get back the amount of your original investment. You should also be aware that past performance may not be a reliable guide to future performance. This document is not intended as investment advice. Any security mentioned in this commentary is for information purposes only and is not a recommendation to buy. Wealth Matters is 4 Shires opinion led commentary. The contents of this webpage are for general information only and do not constitute investment or financial advice. This is not a recommendation to buy or sell any security or to take any action.